On March 2, 2026. the Cleveland County Commissioners took action to move the Arena TIF forward, trying to block city action to repeal.

What did Commissioners do?UNP Arena & Tax Increment Financing ED

This blog is devoted to providing information about Tax Increment Financing (TIF). The goal is promote accountability, transparency and efficacy in economic development policy. I am a Professor of Economics at the University of Oklahoma with over 30 years researching local economic development issues. The views and opinions contained here are solely my own and do not reflect those of the University of Oklahoma.

Monday, March 2, 2026

Cleveland County Commissioners Work to deter Public Vote on Arena

Tuesday, February 17, 2026

Oklahoma Supreme Court shuts down public vote on Arena TIF

On February 3, 2026, the Oklahoma Supreme Court upheld the district court decision which found the referendum petition to be insufficient. The gist statement was determined to be flawed for not including details about triggering events which would end the TIF.

The Chief Justice was the lone dissenting opinion. He argued that the right to a referendum is a "fundamental" citizen right that should not have been blocked over these technicalities.

As reported in nondoc.com

What happens next?

Cleveland County Commissioners have been moving forward with the plan, even before the Supreme Court decision on the referendum was decided.

Norman City Council will explore options regarding the Rock Creek Entertainment District TIF ordinance at a study session on February 17, 2026. Stay tuned...

Friday, August 8, 2025

Cleveland County Commissioners Continue to push Arena Project

On August 7, 2025, the Cleveland County Recreation and Entertainment Facilities Trust held an the 8- minute, special meeting regarding the "Cleveland County arena". Once again, there was no opportunity for public engagement. The Authority's legal counsel, David Floyd, gave a brief presentation after which the 3 County Commissioners and a member that they appointed (with one member absent) approved issuing a Request for Proposal for a builder, designer and operator of the "Cleveland arena project."

The Commissioners/Authority members have not seen a draft of the RFP. There was no discussion of what the RFP should include. Once again, the Commissioners provided no opportunity for public comments.

Attorney Floyd noted that the referendum petition to put the arena project to a public vote is at the State Supreme Court. There is a disagreement about if the arena process is on hold due to the referendum. Attorney Floyd argues that the petitioners did not request an injunction so none exists. Attorney Robert Norman (for ORED) has argued that there is a defacto injunction until the referendum is determined.

After the meeting, I asked Floyd why the County Trust/Commissioners didn't request a delay due to the litigation. He said it wasn't the county's place claiming they "play a small role in the project."

Yes, the Trust is a separate legal entity. It is a creation of the Commissioners and the Commissioners make up 3 of 5 board members (the other 2 were appointed by the Commissioners). The Commissioners role on the authority is to protect the interests of the County.

Floyd also tried to claim that the Commissioners have a small role because a third-party operator will be hired. Who has the responsibility to oversee the operations and management? The Trust/Commissioners. If they choose to hire a third-party operator, the Trust/Commissioners are still responsible for the arena. The County Trust will own the public arena.

It is hard to have faith in County oversight of third-party operators based on the problems at the Cleveland County Detention Center, including troubling health inspection reports and several inmate deaths.

Bottom line - the County has played a HUGE role in steamrolling the arena TIF project forward. The County set up a trust. The Trust will take on massive debt obligations, as well as responsibility for building, maintaining, and operating the facility.

News Articles:

Ana Barboza, OU Daily: Cleveland County requests entertainment district services | News | oudaily.com

Sam Royka, Normant Transcript: County seeks proposals, quotes for Rock Creek Arena Project | News | normantranscript.com

Media Coverage:

John Hayes, Kfor. com: Cleveland Co. moves forward with requests for proposals tied to Rock Creek project

Matt McCabe, news9; Q&A: What’s next for Norman’s Rock Creek Entertainment District?

Sunday, March 23, 2025

MISLEADING THE PUBLIC ABOUT THE UNP ARENA TIF PROJECT

Over 11,000 Norman residents signed a petition to put the Arena TIF (Rock Creek Entertainment District TIF) to a public vote. The referendum gist has been challenged on the grounds that it misleads the public about the nature of the project. The gist describes the ordinance that created the project. It is supposed to be a brief summary of the item that is to be put to a public vote.

In this blog, I note the extensive campaign by Arena PROPONENTS with misleading information about the Arena TIF project. There is a big disjoint between what is described in the project plan and what is contractually required in the Economic Development Agreement. The presentations made to City advisory committees were not consistent with the Economic Development Agreement contract. Even the presentation given at the public hearing was misleading and omitted key information.

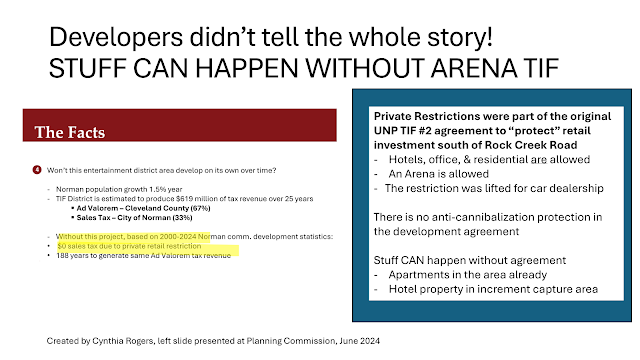

To start, we can look at the presentation given to the City of Norman Planning Commission in June of 2024.

Advisory committees, including the Planning Commission, were shown inflated numbers for the project plan. The plan in the Economic Development Agreement that was approved are much smaller than what the developers presented to advisory committees, city council, and the public.

The Development Agreement indicates only $420 million in private capital investment. There is no penalty if this is not achieved.

The Developers slides do not clarify what is contractually required and what is speculative. The entertainment district activity (retail + hotel) is likely to get built. There is no penalty if it is less than promised. The larger project components are speculative. The Development Agreement indicates that this will "be based on market demand" which removes any minimum requirements. There are not penalties for failure to deliver on promises.

"The Numbers" slide also omits key impacts on taxing jurisdictions. The slide only mentions Cleveland County, but the county only receives about 17% of Ad Valorem revenues. The vast majority of Ad Valorem taxes go to funding schools.

The Developer's slides suggested that nothing would happen in the Arena TIF district without the TIF financing. This is based on two claims; (1) an existing covenant created with University North Park TIF #2 which includes the Arena TIF district, and (2) the undeveloped status of the land.

The covenant which limits retail north of Rock Creek was part of the original University North Park TIF (#2) to protect retail investments from cannibalization. The Arena plan is a way to renegotiate with landowners in the UNP TIF #2 to allow more retail competition. Hotel, office, and residential housing are NOT restricted and can happen without an Arena and TIF. The covenant also excludes car dealerships but that has been circumvented without an Arena or TIF.

The claim of "no risk" for a project of this size is fantasy. The City would not take on the debt, but tax revenues ARE committed to paying off the financing costs (debt + interest) taken on by the Cleveland County Recreation and Entertainment Authority.

Even if the project goes bankrupt, the City would be obliged to make payments to pay off the debt. The payments are limited to tax revenues collected in the TIF district. The risk is that taxpayers sink hundreds of millions into financing a project that is not completed as planned, burdens the future city (county, and school) budgets, and does not create a positive return on investment.

The additional development would include a hotel, residential housing, commercial office which gets developed without TIF in other parts of Norman. Mixed use development is NOT rare in Norman.

TIF obviously benefits some individuals, including landowners, developers, bankers, consultants, lawyers with direct financial interests in TIF based activity. This does not mean that TIFs are positive. Afterall, investors don't profit from all investments. Research suggests that TIF commonly fails to deliver positive economic development. (Merriman 2018 Improving Tax Increment Financing (TIF) for Economic Development - Lincoln Institute of Land Policy).

The claim that the land won't develop without an Arena TIF project is also dubious. The reports (Hunden, HVS) analyzing the project ALL conclude that a significant amount of development is likely to occur on that land without the Arena TIF project.

A PATTERN OF MISLEADING STATEMENTS

In an email exchange, the City of Norman Finance Director recommended that the developers "Be Honest" about the likely negative impact on the City budget and the Reverse Robin Hood effect of the arena TIF.

Saturday, December 21, 2024

Norman Arena TIF Referendum Timeline

This article gives the timeline surrounding the Referendum Petition to allow Norman to vote on the Arena TIF proposal.

November 13, 2023 - City Council approved creating a statutory review committee to make a recommendation about the proposed arena TIF district in the north part of the University North Park District, which was part of the original UNP TIF #2.

April 4, 2024 - pre-development meeting to discuss the site plan and zoning.

April 4, 2024 - Oklahoma Department of Commerce Economic Impact of Norman TIF District

This analysis starts with the development plan provided by OU Foundation and Norman Economic Development Coalition (Hunden Partners Analysis). It does not detail the exact components that were used as inputs. It includes a weather museum which is not part of the development agreement.

The approach is inverted because it estimates the number of jobs associated with projected activity in the TIF district plus the construction of the district itself. Construction job costs become a "benefit" of the project rather than a cost. Further, if a person lives but does not work in the district, their job would be part of the indirect impact of the TIF activity. The analysis also ignores the likely shift of jobs from retail outside the TIF to the TIF.

May 13, 2024 - Statutory Review Committee meeting

May 16, 2024 - Statutory Review Committee recommended approval

The SRC made its recommendation based on the marketing information and analysis related to a larger project than what was later approved by City Council in the development agreement.

The SRC did not consider the financial impacts on the City, County, School District, or Moore-Norman Vo-Tech budgets during the period when the TIF would capture tax revenue growth. No comprehensive cost-benefit analysis was performed.

June 13, 2024 - Planning Commission approves zoning and project plan

June 18, 2024 - Development Oversight Committee for original TIF #2 rejects Arena TIF Plan

The committee voted against the overall project plan in a 3-2 vote with the representative from Norman Public Schools abstaining. The committee's letter expressed "overriding concerns" including:

- Overall amount of future City sales tax and multi-jurisdictional property tax revenue that would be pledged toward the project for up to 25 years;

- Diversion of taxes from properties in University North Park that lie outside the proposed Entertainment District (south of Rock Creek Road)

- Potential negative impact on Norman businesses and the City's General fund and Capital sales Tax Fund through "cannibalization" and diversion of customers from areas of the City outside of the Entertainment District to businesses in the Entertainment District.

July 22, 2024 - Development Oversight Committee for original TIF #2 Meeting

The City Council and City's Attorney's office expressed problems with the development agreement negotiations. The oversight committee members had significant concerns about the proposed arena entertainment district. One member suggested it needed to go back to the drawing board.

August 29, 2024 - HVS releases Sales TIF District Analysis for arena District

This analysis shows how the diversion of sales taxes to the TIF fund will negatively impact the City general fund budget. Note that the Statutory Review Committee did not see this analysis even though it is mandated to consider fiscal impacts on impacted jurisdictions.

September 3, 2024 - First public hearing

Members of the public were given 3 minutes to ask questions. Some, but not all, questions were addressed.

The final development agreement was not complete. This is important because the contractual obligations that OU Foundation/developers agreed to were much smaller than the plan shown to the Statutory Review Committee.

September 12, 2024 - Development Agreement finalized

The development agreement sets out the contractual obligations of OU Foundation/developers for the arena TIF project. The project's scope outlined in the development agreement was much smaller than the $1 billion project approved by the Statutory Review Committee. The Statutory Review Committee reviewed a much larger plan than what was detailed in the development agreement but the authorizes spending was the same $600 million.

September 17/18, 2024 - Second public hearing

OU Foundation/developer gave an extended presentation. OU's president and OU's Director of Athletics were given the opportunity to make comments. OU Students were paid to attend and occupy seats in City Council chambers. Members of the public, including legal and economics subject matter experts, were given 3 minutes each to make comments.

City Council approved the ordinance to create TIF #3 (sales tax capture) and TIF #4 (property tax capture) in a 5 to 4 vote cast after midnight on the 18th.

September 20, 2024 - Citizens file Referendum Petition to put the TIF Plan to a public vote. www.responsibleok.com.

October 17, 2024 - Referendum Petition signatures were submitted to City Clerk

November 6, 2024 - City Clerk certified sufficient signatures to put Arena TIF to a vote on February 11, 2025.

November 18, 2024 - Legal protest filed against Referendum Petition

Four Norman businessmen filed a legal petition challenging the sufficiency of the Referendum Petition:

- David Nimmo, CEO of Chickasaw Nation Industries, Board Chair of Norman Economic Development Coalition,

- Vernon McKown, CEO of Ideal Homes,

- Dan Quinn, real estate agent,

- Kyle Allison, Allison's Fun Inc.

February 19, 2024 - Case heard by Judge Virgin. Challengers argued that gist was deceptive and lacked key elements. Referendum filers argued that it was a good gist and summarized the ordinance and that it would lead to a vote on the ordinance.

As reported by NonDoc.com - Norman TIF saga continues as judge blocks public vote

“This right is precious,” Norman said. “This is what separates us from the oligarchs, the monarchs, and the dictators and the few who would seek to influence them by going against the will of the people.”

Norman said the protestants “denigrate the signatories” by arguing they would not understand the gist as written. Further, he argued distilling the 133-page project plan into a short paragraph will always, by nature, require omission of some detail, but the level of omission must constitute “fraud” to warrant being struck from a ballot.

February 21, 2024 - Judge Virgin rules the gist is insufficient striking down the public vote on the arena TIF ordinance. Court rejects petition against Norman TIF: Key dates, funding, and project timeline

March 7, 2025 - Cleveland County Recreation and Entertainment Facility Authority approved Economic Development Agreement for Arena TIF district in a special meeting called with the minimum required 48-hour notice. No public comment was allowed. The Commissioners did not discuss the financial implications of taking on debt needed to finance $230 million in project costs, or the requirement to build, operate and manage an 8,000 seat arena and parking structure. The only commissioner comment was Rod Cleveland who noted that the agreement was "the exact same thing" that the city approved.

There was no discussion of the Referendum petition signed by over 11,000 Norman (and Cleveland County) residents. The legal process has not been completed.

Cleveland County leaders approve Norman entertainment district plan

March 18, 2024 - ORED Appeals Gist Challenge, files appeal at Oklahoma Supreme Court.

March 27, 2025 - Oklahoma Supreme Court grants request to hear the case

April 29, 2025 - May 15, 2025 - motions were made to forgo and to retain oral arguments. The Supreme court has not decided this issue. Briefs can be found here - https://www.normanok.gov/information-proposed-entertainment-district

April 29, 2025 - Brief of respondents (defending the referendum) https://www.normanok.gov/file/31410/download?token=phLi0MmL

May 10, 2025 - Norman City Council voted to approve the Phasing Plan contingent on the Supreme Court decision to throw out the Referendum, or a majority vote of the public.

May 19, 2025 - Answer Brief of petitioners (opposing the referendum) - https://www.normanok.gov/file/31409/download?token=BKAASprQ

May 25, 2029 - Final Brief of respondents (defending the referendum) - https://www.normanok.gov/file/31410/download?token=phLi0MmL

STAY TUNED FOR UPDATES ON SUPREME COURT DECISION

Friday, October 25, 2024

Referendum Effort Almost Doubles Signatures Needed

This article provides a brief history of the referendum petition related to the proposed UNP arena district in Norman, Oklahoma. Link to project plan

City Council approved an ordinance creating the Rock Creek Entertainment TIF district by a vote of 5 to 4. There were two public hearings held two weeks apart. These were contentious for multiple reasons. The opposition to the ordinance led to the creation of the non-profit, Normans for Responsible Economic Development and a referendum petition effort that submitted 11,602 signatures to the City Clerk.

FIRST PUBLIC HEARING

The first hearing on September 3, 2024 was intended to be a question and answer format. Residents were not aware that comments had to be made in a question format and some were deterred from commenting.

Notably a group of OU students showed up two hours early for this meeting.

SECOND PUBLIC HEARING:

The second hearing on September 17, 2024 was grossly one-sided. OU Foundation and the Texas Development partners (Rainier) were given as much time as they wanted. OU President Harroz was given time to make comments even though OU is not a party in the economic development contract. OU Foundation is the landowner and developer of record.

Subject matter experts were limited to 3 minute comments. Attorney Robert Norman, who sits on the University North Park TIF #2 committee and has knowledge of the contents of the ordinance and the development agreement, was given 3 minutes to make comments. Dr. Cynthia Rogers (that's me), OU professor of Economics and subject matter expert on TIF, public finance, and local economic development was also limited to 3 minutes.

OU STUDENTS WERE OFFERED PAYMENT TO OCCUPY COUNCIL CHAMBERS

Over 60 OU students attended the meeting, showing up early and taking seats in the City Council meeting room. OU President Harroz pointed them out and a made a big deal about their attendance.

It was later discovered that those students were offered payment to show up and serve as props. When OU Daily asked students why they showed up (audio) none mentioned they were offered payment. OU Daily obtained a message sent by OU Sophomore, David Echols, which offered payment to students to attend the meeting. Echols denied sending the message despite the evidence (OU Daily article).

OU Daily's investigation discovered the source of the payment offer - Jayke Flaggert, an OU alumni, a former employee and current subcontractor for Norman Economic Development Coalition (Link to OU Daily article). It is unclear who covered those payments. NEDC, OU Foundation, OU Athletics, OU President's office have all denied knowledge of the payments. Link to OU Daily video

DEVELOPMENT AGREEMENT WAS NOT DISCUSSED

The development agreement which creates the contractual obligations related to the TIF ordinance was released to the public a mere 4 days prior to the second public hearing. There was little time to dig into the peculiar and vague language and there was not additional/separate public discussion on the actual contract.

COUNCIL APPROVED TIF ORDINANCE

City Council approved the creation of the UNP Arena TIF with the minimum number of votes needed in a 5 to 4 vote. Voting for were Mayor Heikkila, council members Scott Dixon (Ward 8), Matt Peacock (Ward 2) , Joshua Hinkle (Ward 6), and Austin Ball (Ward 1). Voting against were council members Bree Montoya (Ward 3), Michael Nash (Ward 5), Helen Grant (Ward 4), and 2025 mayoral candidate Stephen Tyler Holman (Ward 7).

OKLAHOMANS FOR RESPONSIBLE ECONOMIC DEVELOPMENT (ORED)

ORED is a grass roots, non profit organization formed by Norman residents who seek to provide residents with a voice in economic development matters. Their first action was to organize a referendum petition allowing Norman residents to vote on the UNP Arena TIF ordinance. ORED website

A referendum petition is built into the Local Development Act which enables the formation of TIF district in Oklahoma. It is the last recourse for voters if they do not agree with a legislative action. A petition requires considerable effort and organization. There are specific requirements for the petition packets, including the wording of a gist statement summarizing the issue, the signature page, and a copy of the actual ordinance to be put up to vote. Once the packet is drafted, it is filed with the City Clerk who reviews it and then stamps the date it was filed.

REFERENDUM PETITION SUCCESS

The referendum petition on the UNP Arena TIF ordinance was filed by three Norman residents, Pamela Mccoy-Post, Paul Arcaroli and Richard Sondag, on Sept. 20. If successful, the petition would put the ordinance approving the UNP arena TIF to a public vote on February 11. The required number of valid signatures is 25% of the number of voters who cast a ballot in the most recent Mayoral election, which was 6,098 in this case.

Over a hundred volunteers participated in the signature gathering process. Women in Action for All of Norman organized training events for volunteers to understand the legal requirements for collecting signatures. Volunteer notaries were available for notarizing signed petition packets. Several businesses, including Stash, Green Feather, Alameda Market, B&B Liquor Market, supported the effort by having petitions on hand. Roots Salon allowed a tent to be in place daily for drive-up signature gathering. The location was moved to Yellow Dog Coffee's parking lot for better traffic Flow. Pink Pig and St. Stephens UMC allowed petition collection and notarizing on their premises.

On October 15, 2024, ORED and petition volunteers submitted 11,602 signatures on the referendum petition.

"Municipal Referendum Act and the Local Development Act required us to get 6098 signatures, I am happy to tell you that our official signatures we are submitting is 11,602," said Attorney Rob Norman. (Fox25news)

WHAT COMES NEXT?

The city clerk has 30 days to validate that enough signatures from registered voters in Norman were collected.

Then there is a 10 day period for challenges. There was a challenge by 3 former Norman mayors the last time residents filed sufficient signatures for a referendum petition on the UNP TIF #2 amended project plan.

If the petition survives legal challenges, then voters will get to cast a ballot on Feb 11. Legal challenges could delay the vote to the April election.

Arena Referendum Offers Community Building Opportunity

This letter to the editor was published in the Norman Transcript, October 23, 2024.

link to lte

Arena referendum offers opportunity for community building

Norman’s experience with TIF targeting public spending in the University North Park district between Robinson and Tecumseh continues to divide our community. Norman has been here before. Lather, rinse, repeat.

A referendum petition is the voter’s goal line stance against controversial projects approved by council. All council votes on UNP TIF projects have been controversial.

The proposed UNP Arena TIF was approved by a 5 to 4 vote, the bare minimum needed. The original UNP TIF #2 for the Target anchored retail strip mall and the amended TIF #2 agreement which ended the TIF diversion to balance the city general fund also passed with only 5 council votes.

The referendum petition offers a chance for community dialogue and engagement that should have happened at the beginning of the process.

Do Norman voters want to spend up to $600 million tax dollars on an arena rather than other things? Do Norman voters want to pour more tax dollars into the UNP area which already benefited from TIF #2? Would other areas give a bigger band for public tax spending infusion? Do Norman voters trust a county authority to build, own, and operate an arena? What happens if the project goes belly-up before completion?

This is not the first Norman referendum on UNP TIF projects. In 2019, citizens collected enough valid signatures in to put the amended UNP TIF #2 agreement to a vote. In exchange for ending the TIF diversion which was needed to balance the city general fund, the developers were no longer required to completing the promised (and still not built) lifestyle center or refund its share of Legacy Park which was tied to lifestyle completion. Legal challenges prevented voters from getting to vote on the agreement.

A referendum petition is citizen’s only recourse when the process does not lead to a plan broadly acceptable to voters. Mayor Heikkila, OU Leadership, Norman Economic Development Coalition, and the UNP arena development partners have demonstrated a gross disrespect for citizen input and the petition process.

A referendum petition is the red zone for creating a TIF district. Gathering over 11,600 signatures is not an easy or cheap task. The level of community support for the petition demonstrates a strong and clear message about the TIF plan.

As Norman resident await signature validation, what will Norman business and OU leaders be doing? Will they pursue legal tactics to try to throw out the strong and clear desire to vote on the project? Will they, instead, participate in forums and townhalls with balanced discussions?

If the arena project is so good for Norman, make the case, engage the community, respect the process. Let’s brainstorm as a community on financing that makes sense and does not burden future city, county, and school budgets.

Above all, please be good neighbors.

Cynthia Rogers, Norman