What is Tax Increment Financing?

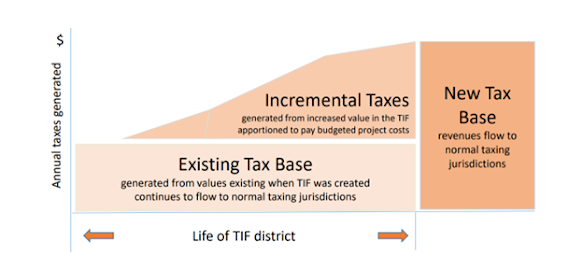

It is a way to finance debt for a capital project. It allows

tax revenues collected in a designated area (increment district) to be spent on

TIF project costs instead of going to original taxing jurisdictions. Incremental

taxes are the growth in taxes generated in the increment district above the

baseline which is typically frozen at the pre-TIF level. The TIF agreement

establishes the % of the incremental taxes diverted to TIF projects.

Legal Authorization of TIF Districts in Oklahoma

- Authorized by Article X, Section 6C of Oklahoma Constitution

- Established pursuant to Local Development Act, Title 62, Oklahoma Statutes, Section 850 et seq.

Length of Increment collection period and TIF project

- TIF plans set the length as the minimum of the time needed to pay for project costs or a set number of years (25 years is maximum allowed)

- 25 years is common, but not universal maximum length of increment collection period

- Enid (#7) – 10 years, Sapulpa (#4) – 15 years; El Reno (#4) – 20 years.

Life of TIF (vs. Increment diversion)

- A TIF is closed out when all funds are spent OR the termination date is reached (25 years is max by law).

- The UNP TIF #2 increment diversion ended in 2019 but the TIF district will end in 2030 or when the remaining funds are spent.

The UNP Arena Project Plan proposes two new tax increment finance schemes which have the same increment district from which 100% of sales taxes (TIF #4) and ad valorem taxes (TIF #5) are grabbed

The sales tax diversion (TIF #4) would start sooner to

reflect the retail that is ready to be built south of Rock Creek across from

the Young Family Athletic Center. This area is site ready for new construction.

1. Why

is the land south of Rock Creek, adjacent to the Young Family Athletic Center,

in the district from which tax revenues will be used to pay for arena project

costs? How does re-TIFing this property

impact NPS budget? Isn’t the goal of a

TIF to give up funds for a while to get more later? Won’t this plan grab some

of the payoff from TIF #2 for up to another 25 years?

Answer: This land is probably the most valuable undeveloped real estate in

Norman. It will develop without being in a new TIF district. The project needs

quick revenues to start paying off the debt. The Rainer Associates LLC is

taking on debt before revenues flow in.

IMPACT

on NPS: Giving this up will hurt NPS budget – it is revenue growth that

would otherwise go to the school budget (sinking, general and building funds)

without the TIF.

2. Isn’t 25 years a long time to lock in on

a TIF? The last school bond was

historically large ($ 350 million) and long (10 years vs. 5 years for previous

bonds). Are shorter TIF allowed? Would shorter TIF plans make school budgeting

easier?

Answer: 25 years is the maximum allowed. Developers like the longer period to keep a

project live and allows flexibility for renegotiating and maximizing

opportunity to spend all the designated funds.

Examples of shorter TIF projects in Oklahoma include Enid (#7) – 10 years,

Sapulpa (#4) – 15 years, El Reno (#4) – 20 years

Impact on NPS: The longer

the duration of the TIF increment diversion the more NPS budget years which are

negatively impacted.

3. Why is a 100% diversion acceptable for

the district? Are there other 100% TIF ad valorem projects, or is this rare?

The original UNP TIF split the

growth in ad valorem tax revenues in the increment district evenly. The proposed UNP arena TIF contemplates a

100% (TIF) and 0% (School) split.

a. What are the advantages of the 50-50% split vs.

100% split?

Answer: the 50% split to the school district is

not treated as local revenue that is deducted from state aid revenues (not a

chargeable). Accounting for the

equalization in the state aid formula, the school district gets more state aid

revenues from 50% of ad valorem revenues collected in the TIF than it would

from 100% of the same amount of revenues without the TIF.

b. Does TIF reduce school funding in Oklahoma?

Answer: YES, It diverts local school

funding to non-school purposes.

3. By how much will non-Sinking Fund Revenues be harmed?

a. How much of each extra dollar of ad valorem

taxes does the school district keep accounting for the deduction of local

revenue in the school aid formula, as well as the building fund?

Answer:

It is NOT a $1 for $1 deduction because the building fund is not a

chargeable item. Of the 45 mills (.045)

school tax, the district keeps about 6.5 mills (.0065) after accounting for the

chargeables. (Steve Ellis has

painstakingly estimated this. You could ask for the CFO’s numbers on this.)

b. The Project plan (page 14) claims that the state aid formula will offset 79% of new non-sinking fund revenues, so the district gets to keep 81% of net new non-sinking fund revenues. Is this correct? Where does this number come from?

c. What would be the hit from the non-sinking funds

for the estimated $3.25 billion worth of property whose taxes are completely

diverted to the TIF? Does $21 million

sound about right?

Answer: The diversion from non-sinking

funds is just over $21 million. The school district gets to keep about 6.5

mills from the 45 mill school levy.

Thus, .0065 x $3,250,000,000 = $21,125,000

4.

How long will it take for the school

district to make-up the forgone non-sinking fund revenues to make the NPS

budget whole?

The City’s Project plan estimates

a “net increase in non-sinking fund revenue to the school district of

approximately $1,680,000 annually.” (page 9).

No estimates of the yearly impacts are given for the years when

non-sinking fund ad valorem taxes are diverted to the UNP TIF fund.

a.

What is the annual hit on the school non-sinking

funds revenues during the diversion period?

Answer:

$21 million spread over say 20 years is a little over $1 million per

year ($1,056,250). Is this in the ballpark? (NPS has not responded to this inquiry.)

b.

How many years after the project costs are paid

off will it take to make up those foregone revenues?

Answer: Back of the envelop estimation

suggests it would take a little over a dozen years after the increment diversion

ends to make up for lost revenues. ($21.125 million foregone divided by $1.68

million per year after diversion ends = 12.57 years.)

c.

How will the annual school budget be impacted if

there is $1 million hit annually during the period that the TIF project is

being paid off?

Answer: It isn’t clear how NPS would address

the revenue hit. How many teachers is this?

How many buses?

5.

Sinking funds are used to pay off bond

debt and judgements. How does diverting

100% of sinking funds impact the school district budget?

a.

What happens if the sinking fund revenues don’t

grow as fast as expected due to the concentration of new growth in Norman

happening in the new TIF district (1,000 new housing units, new bars and

restaurants, etc.)?

Answer: the county assessor will

adjust the school sinking fund millage rate to cover the sinking fund

obligations. This will impact TIF and NON-TIF ad valorem tax rates. (I suppose

the assessor could also increase property values instead of the millage rate –

either way this could lead to a tax increase for non-TIF property owners).

b.

What has happened to the NPS sinking fund

millage rate since the last bond election?

NPS promised taxpayers it would not increase when asking for 2023 bond

approval.

Answer: It has increased

slightly since last year. CFO should

have numbers on this.

6.

The schools that include the UNP TIF area

are at capacity already. How much does a new elementary school cost to build,

including land costs? What about extra transportation to serve a new school?

Answer

– Elementary school costs would depend on size of the building. The cost would

be put in a bond package in the future.

Will voters support a bond for a new school in the UNP when the ad

valorem taxes paid by property owners in the UNP TIF would go to the arena

project and not to paying off the bond to build a new school there? That might ruffle voter feathers.

7.

OU Foundation CEO (Guy Patton) provided a letter of intent

(not an actual contract) to offer UNP land to NPS with an option to purchase

(not free).

a. How

will this impact NPS’s ability to pay for a future school?

Answer – The letter possible sites offered in

the letter of intent are not suitable for a school. They are bordered by a car

dealership to the west and an industrial activity (Southwest Wire) to the

north.

b. What is this land worth?

Answer: The price quoted was $8

per gross square foot with a detention pond thrown in at a nominal cost. If the non-detention pond area is

approximately 5.5 acres, bringing the purchase price to about $1.9 million. A

detention pond is not buildable, it is a liability. It is unclear if this is a good price given

its location and the surrounding land uses.