This article gives the timeline surrounding the Referendum Petition to allow Norman to vote on the Arena TIF proposal.

November 13, 2023 - City Council approved creating a statutory review committee to make a recommendation about the proposed arena TIF district in the north part of the University North Park District, which was part of the original UNP TIF #2.

April 4, 2024 - pre-development meeting to discuss the site plan and zoning.

April 4, 2024 - Oklahoma Department of Commerce Economic Impact of Norman TIF District

This analysis starts with the development plan provided by OU Foundation and Norman Economic Development Coalition (Hunden Partners Analysis). It does not detail the exact components that were used as inputs. It includes a weather museum which is not part of the development agreement.

The approach is inverted because it estimates the number of jobs associated with projected activity in the TIF district plus the construction of the district itself. Construction job costs become a "benefit" of the project rather than a cost. Further, if a person lives but does not work in the district, their job would be part of the indirect impact of the TIF activity. The analysis also ignores the likely shift of jobs from retail outside the TIF to the TIF.

May 13, 2024 - Statutory Review Committee meeting

May 16, 2024 - Statutory Review Committee recommended approval

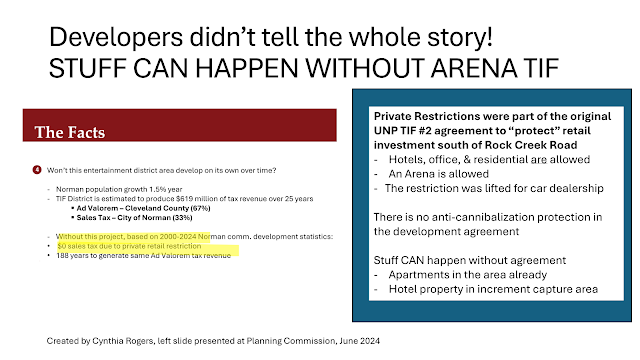

The SRC made its recommendation based on the marketing information and analysis related to a larger project than what was later approved by City Council in the development agreement.

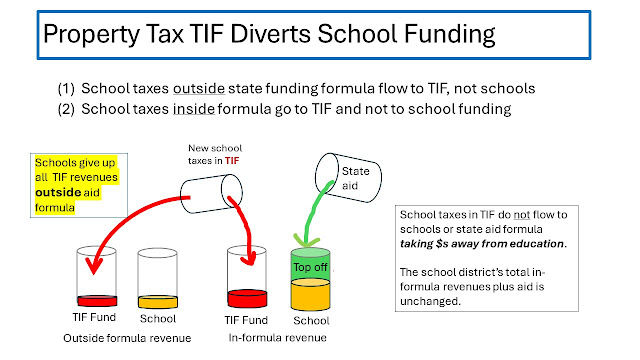

The SRC did not consider the financial impacts on the City, County, School District, or Moore-Norman Vo-Tech budgets during the period when the TIF would capture tax revenue growth. No comprehensive cost-benefit analysis was performed.

June 13, 2024 - Planning Commission approves zoning and project plan

June 18, 2024 - Development Oversight Committee for original TIF #2 rejects Arena TIF Plan

The committee voted against the overall project plan in a 3-2 vote with the representative from Norman Public Schools abstaining. The committee's letter expressed "overriding concerns" including:

- Overall amount of future City sales tax and multi-jurisdictional property tax revenue that would be pledged toward the project for up to 25 years;

- Diversion of taxes from properties in University North Park that lie outside the proposed Entertainment District (south of Rock Creek Road)

- Potential negative impact on Norman businesses and the City's General fund and Capital sales Tax Fund through "cannibalization" and diversion of customers from areas of the City outside of the Entertainment District to businesses in the Entertainment District.

July 22, 2024 - Development Oversight Committee for original TIF #2 Meeting

The City Council and City's Attorney's office expressed problems with the development agreement negotiations. The oversight committee members had significant concerns about the proposed arena entertainment district. One member suggested it needed to go back to the drawing board.

August 29, 2024 - HVS releases Sales TIF District Analysis for arena District

This analysis shows how the diversion of sales taxes to the TIF fund will negatively impact the City general fund budget. Note that the Statutory Review Committee did not see this analysis even though it is mandated to consider fiscal impacts on impacted jurisdictions.

September 3, 2024 - First public hearing

Members of the public were given 3 minutes to ask questions. Some, but not all, questions were addressed.

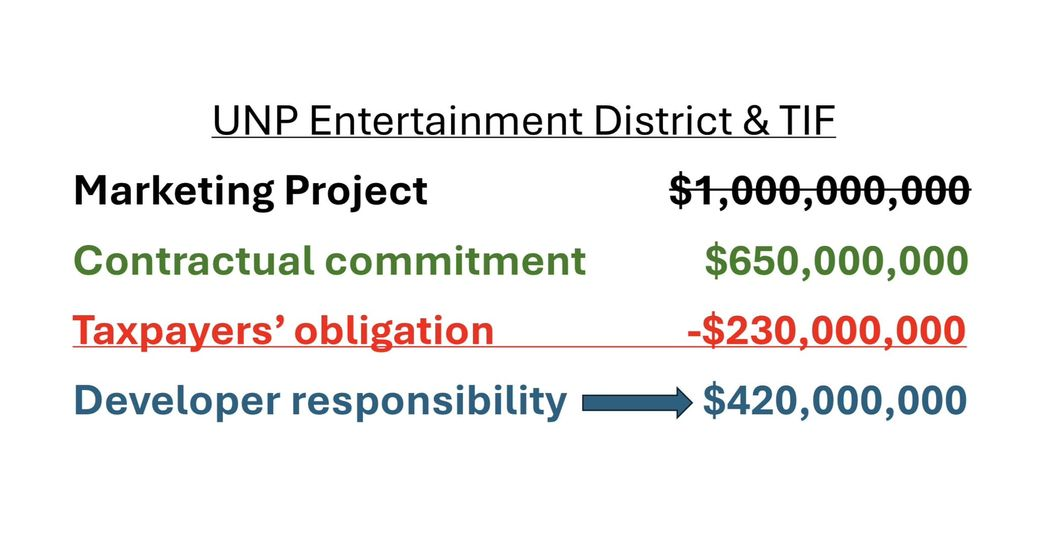

The final development agreement was not complete. This is important because the contractual obligations that OU Foundation/developers agreed to were much smaller than the plan shown to the Statutory Review Committee.

September 12, 2024 - Development Agreement finalized

The development agreement sets out the contractual obligations of OU Foundation/developers for the arena TIF project. The project's scope outlined in the development agreement was much smaller than the $1 billion project approved by the Statutory Review Committee. The Statutory Review Committee reviewed a much larger plan than what was detailed in the development agreement but the authorizes spending was the same $600 million.

September 17/18, 2024 - Second public hearing

OU Foundation/developer gave an extended presentation. OU's president and OU's Director of Athletics were given the opportunity to make comments. OU Students were paid to attend and occupy seats in City Council chambers. Members of the public, including legal and economics subject matter experts, were given 3 minutes each to make comments.

City Council approved the ordinance to create TIF #3 (sales tax capture) and TIF #4 (property tax capture) in a 5 to 4 vote cast after midnight on the 18th.

September 20, 2024 - Citizens file Referendum Petition to put the TIF Plan to a public vote. www.responsibleok.com.

October 17, 2024 - Referendum Petition signatures were submitted to City Clerk

November 6, 2024 - City Clerk certified sufficient signatures to put Arena TIF to a vote on February 11, 2025.

November 18, 2024 - Legal protest filed against Referendum Petition

Four Norman businessmen filed a legal petition challenging the sufficiency of the Referendum Petition:

- David Nimmo, CEO of Chickasaw Nation Industries, Board Chair of Norman Economic Development Coalition,

- Vernon McKown, CEO of Ideal Homes,

- Dan Quinn, real estate agent,

- Kyle Allison, Allison's Fun Inc.

February 19, 2024 - Case heard by Judge Virgin. Challengers argued that gist was deceptive and lacked key elements. Referendum filers argued that it was a good gist and summarized the ordinance and that it would lead to a vote on the ordinance.

As reported by NonDoc.com - Norman TIF saga continues as judge blocks public vote

“This right is precious,” Norman said. “This is what separates us from the oligarchs, the monarchs, and the dictators and the few who would seek to influence them by going against the will of the people.”

Norman said the protestants “denigrate the signatories” by arguing they would not understand the gist as written. Further, he argued distilling the 133-page project plan into a short paragraph will always, by nature, require omission of some detail, but the level of omission must constitute “fraud” to warrant being struck from a ballot.

February 21, 2024 - Judge Virgin rules the gist is insufficient striking down the public vote on the arena TIF ordinance. Court rejects petition against Norman TIF: Key dates, funding, and project timeline

March 7, 2025 - Cleveland County Recreation and Entertainment Facility Authority approved Economic Development Agreement for Arena TIF district in a special meeting called with the minimum required 48-hour notice. No public comment was allowed. The Commissioners did not discuss the financial implications of taking on debt needed to finance $230 million in project costs, or the requirement to build, operate and manage an 8,000 seat arena and parking structure. The only commissioner comment was Rod Cleveland who noted that the agreement was "the exact same thing" that the city approved.

There was no discussion of the Referendum petition signed by over 11,000 Norman (and Cleveland County) residents. The legal process has not been completed.

Cleveland County leaders approve Norman entertainment district plan

March 18, 2024 - ORED Appeals Gist Challenge, files appeal at Oklahoma Supreme Court.

March 27, 2025 - Oklahoma Supreme Court grants request to hear the case

April 29, 2025 - May 15, 2025 - motions were made to forgo and to retain oral arguments. The Supreme court has not decided this issue. Briefs can be found here - https://www.normanok.gov/information-proposed-entertainment-district

April 29, 2025 - Brief of respondents (defending the referendum) https://www.normanok.gov/file/31410/download?token=phLi0MmL

May 10, 2025 - Norman City Council voted to approve the Phasing Plan contingent on the Supreme Court decision to throw out the Referendum, or a majority vote of the public.

May 19, 2025 - Answer Brief of petitioners (opposing the referendum) - https://www.normanok.gov/file/31409/download?token=BKAASprQ

May 25, 2029 - Final Brief of respondents (defending the referendum) - https://www.normanok.gov/file/31410/download?token=phLi0MmL

STAY TUNED FOR UPDATES ON SUPREME COURT DECISION