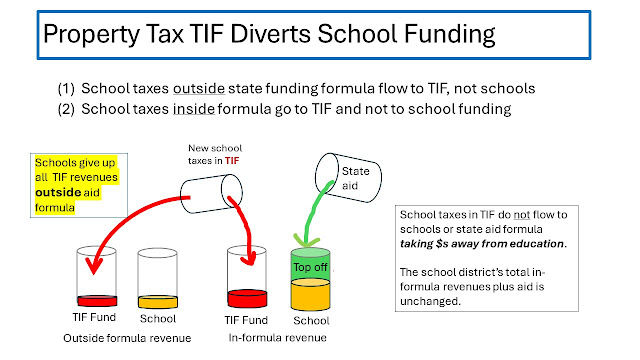

In this article, I will explain how the Arena Tax Increment Finance (TIF) plan will take revenue growth from Norman Schools. Imagine you plan for 4.25% tax revenue growth but some of that will go to a build an arena instead of flowing to your budget. This is the situation with the Arena TIF.

I will dispute some misleading/incorrect assertions made to make it seem that the Arena TIF does not harm public education. We want the project to leave school funding harmless. This, however, is not going to happen for a project that could grab $389 million in property taxes.

Myth #1 - The Arena TIF does not impact current budgets so it won't harm schools.

Discussion: Whereas it is true that current budgets are not impacted this is a silly statement. The TIF plan impact budgets going forward. Future school revenues will be impacted. (see details below)

Myth #2 - Norman School District will not benefit from revenue collected in the TIF district because the school aid formula will offset new school revenues.

Discussion: This is clearly false. Not all school taxes are factored in the school aid formula. As properties come onto tax rolls, Norman Schools get more revenues. TIF grabs school taxes that would otherwise go to schools.

Myth #3- Nothing would happen in the Arena TIF district without spending $600 million on the arena, parking garage and public infrastructure.

Discussion: This is a far-fetched claim. (1) The Arena project mostly involves moving (OU sports) and replicating entertainment opportunities (bars and restaurant) already happening in Norman. (2) The tax diversion district includes properties that have no commercial retail restrictions, are adjacent to operating businesses and the Young Family Athletic Center which attracts a lot of foot traffic. These will go on the tax rolls without an arena. (see details below)

Here are some slides with details:

No comments:

Post a Comment